As bitcoin has matured over the years, both its own narrative as well as the general macro narrative have evolved. Nic Carter does a great job of summarizing the various Bitcoin narratives in his Medium article entitled, “Visions of Bitcoin.”

When the global Coronavirus pandemic hit in 2020, the focus of the Bitcoin narrative clearly became “censorship-resistant E-Gold”. With the massive amount of money printing that happened in response to the pandemic, institutions (including Microstrategy’s Michael Saylor) found Bitcoin to be an excellent inflation hedge: the ultimate store of value 10X better than gold.

In the video below, Lyn Alden provides a 2021 Macro outlook and discusses where Bitcoin fits within the current landscape.

Regardless of the short-term macro environment, it is important to note that Bitcoin is designed to appreciate in value…forever. Bitcoin brings censorship-resistant sound money to the world…and a free and open-source monetary network that facilitates financial inclusion for all. In an inflationary fiat currency-dominated world, Bitcoin (with its limited supply and declining issuance schedule) is inherently deflationary and designed to appreciate against all other inflationary assets. Michael Saylor exemplifies this point in the following short video clip:

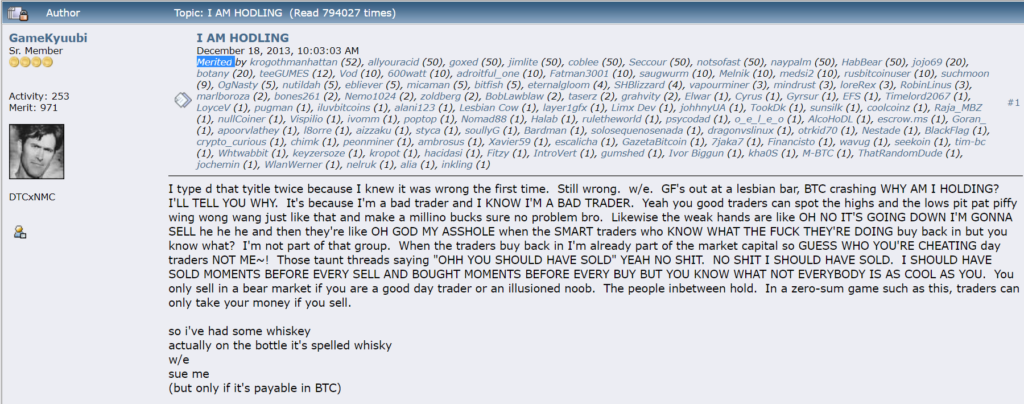

Just remember friends: the best advice any bitcoiner can give to another is to HODL and accumulate. The macro environment will always go up and down and sideways, but bitcoin is designed to go up long term. But don’t take our word for it…take it from the original HODLER from Bitcointalk.com in the original post shown below.

Disclaimer

This site is for informational and entertainment purposes, and should not be construed as personal investment advice.